capital gains tax increase canada

So for example if you buy a stock at 100 and it earns 50 in value when you sell it the total capital. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on 100 per cent of her capital gains.

Good Tax Policy Helped Canada Become Home To The World S Most Affluent Middle Class Tax Foundation

The recent passage of Bill C-208 exacerbates.

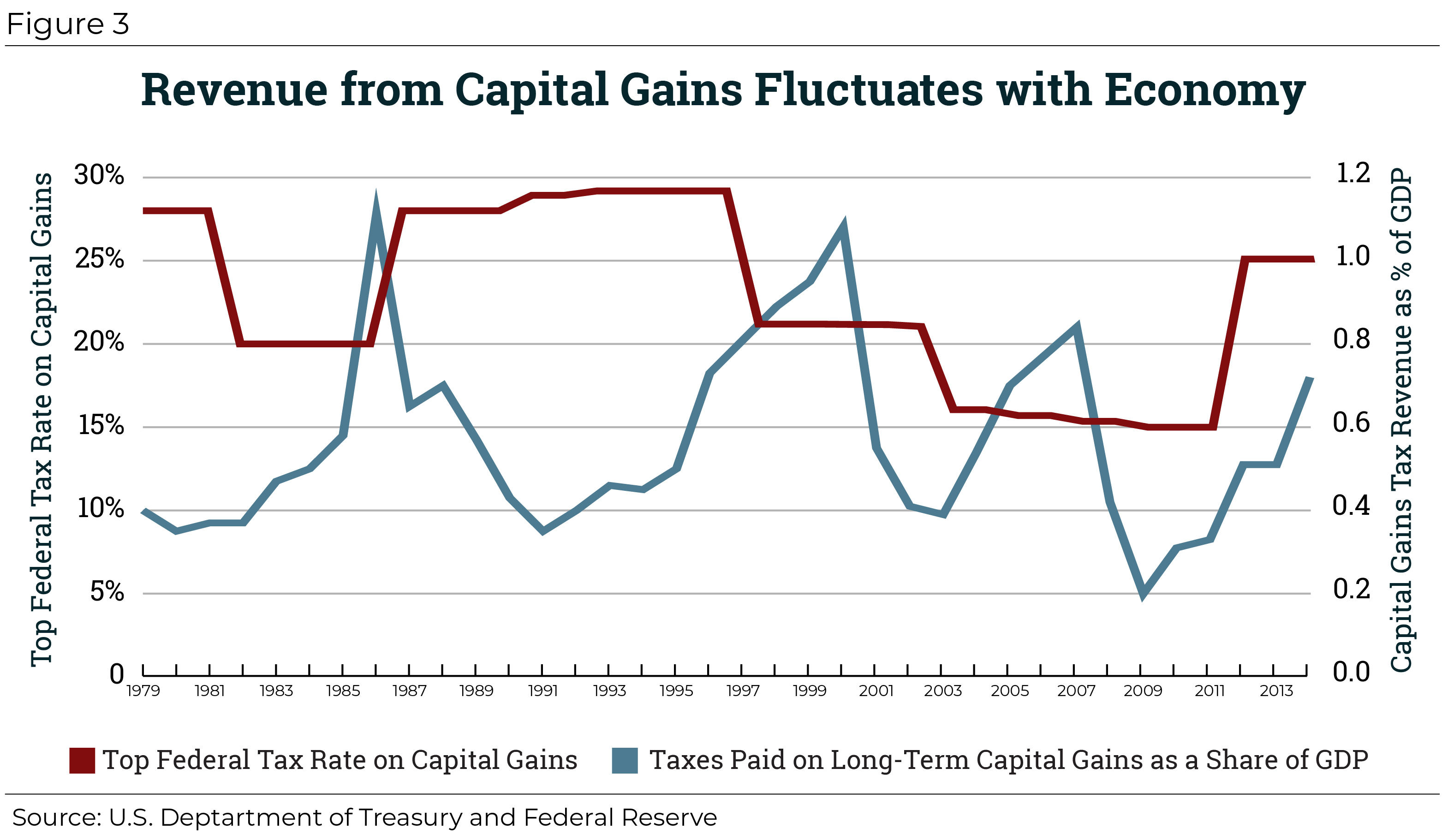

. More than 80 percent of gains. The inclusion rate has varied over time see graph below. In all Canadians realized 729 billion in taxable capital gains.

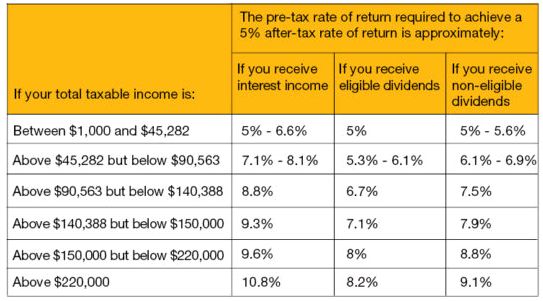

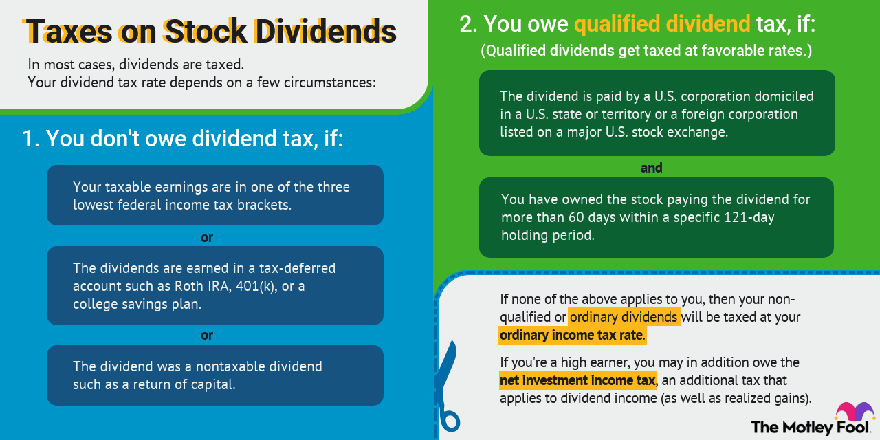

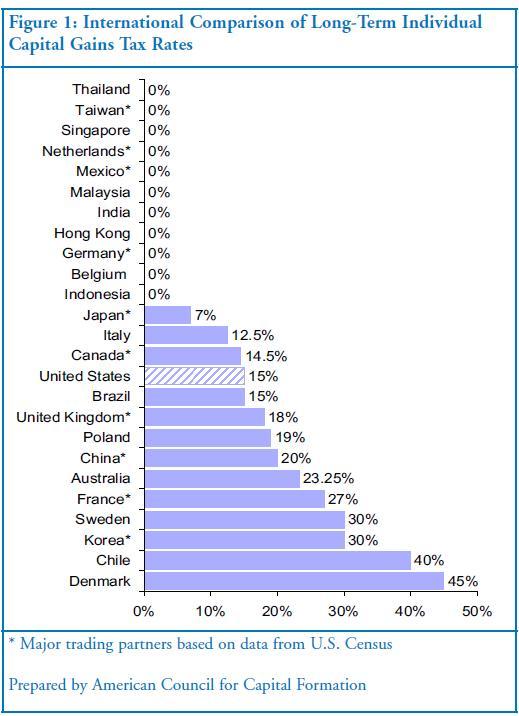

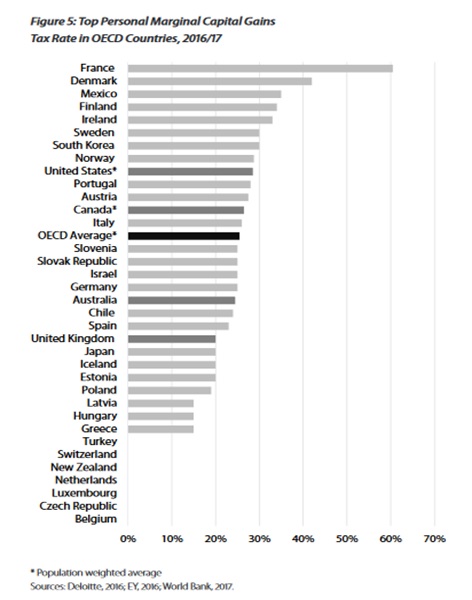

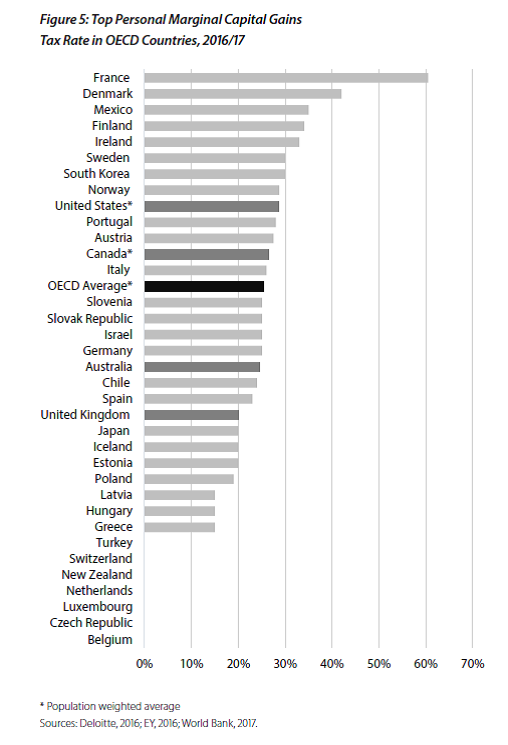

And the tax rate depends on your income. Of the total 546 percent was declared by taxpayers with incomes over 250000. In Canada capital gains are taxed very favourably with only 50 of a capital gain being taxable.

4 hours agoCanadas proposed buyback tax could be viewed as a means of limiting these tax efficiencies and levelling the playing field. If the heir owns the property for more than a year he or she will be taxed at 0 15 or 20 on the long-term capital gains. As of 2022 it stands at 50.

To emphasize how favourable this is consider a. A 1031 tax deferred exchange which allows an heir. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

The capital gains tax is the same for everyone in Canada currently 50. Special to The Globe and Mail. Published January 12 2021 Updated February 9 2021.

How to prepare for a potential tax hike on capital gains. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

The inclusion rate is the percentage of your gains that are subject to tax. Capital gains tax CGT is levied on the rise in value of an. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. The current capital gains tax preferences cost 35 billion annually with high-income families accruing most of the benefit. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

Chancellor Jeremy Hunt wants a major shake-up of the tax to increase revenues from the current 10billion a year. The government predicts the proposed share. For a Canadian who falls in a 33 marginal.

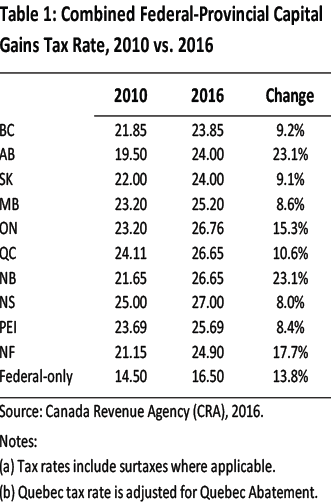

In this commentary we discuss the findings from our new research on the estimated impact of the 1994 reform that dramatically increased the tax rate on capital gains. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the.

A weak taxpayer reaction would reduce capital gains tax revenues raised by the increase from 23 to 35 percent depending on the degree of the tax increases. When the tax was first. An examination of the taxation of capital gains in Canada suggests that this objective would be better achieved with a reduction in the inclusion rate of capital gains The.

Capital Gains in Canada.

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Capital Gains Tax Hike Would Be Disastrous For Economic Recovery Fraser Institute

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

How Are Dividends Taxed Overview 2021 Tax Rates Examples

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Why Do People Buy Us Stocks And London Stocks When Both Countries Tax Capital Gains By A Lot And Dividends By A Lot Why Don T People Invest In Other Non Western Stock Exchanges

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

Personal Income Taxes And The Capital Gains Tax Fraser Institute

Net Capital Gains Tax Would Approach A Whopping 60 Under Biden S Proposal Mish Talk Global Economic Trend Analysis

Why Capital Gains Tax Rates Should Be Lower Than Those On Labor Income American Enterprise Institute Aei

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Entrepreneurship Growth And Capital Gains Taxation

Demographics And Entrepreneurship Blog Series Spurring Entrepreneurship Through Capital Gains Tax Reform Fraser Institute

Tax Implications For U S Investors Owning Canadian Stocks

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay